This document endeavors to collect some of the frequently asked questions to the Lake Placid WCID No. 1 Board of Directors and our consultants during this election process.

1. What is a Water Control and Improvement District (WCID)?

A WCID is a type of conservation and reclamation district empowered by the State of Texas to control and preserve the waters of the State of Texas. A WCID is empowered to finance, build, construct, improve, reconstruct, repair and maintain dam facilities. It is a type of governmental entity and will be governed by a board of directors elected by the registered voters within the District. Upon approval by voters, a WCID is authorized to levy annual ad valorem property taxes to fund district operations and costs. Our plan is for the WCID to work with GBRA to fund and repair the Lake Placid Dam and maintain the lake at its normal level, but with a modern dam and funding to ensure it is maintained in perpetuity. As all other efforts to seek funding have been unsuccessful to date, the WCID is presently the only means of raising the necessary financing to make the repairs to the dam.

The WCID will operate as an agency of the State of Texas and will oversee and approve the repair and construction of the dam by GBRA, collect both the property tax through the County Tax Assessor and collect gross GBRA Hydroelectric Revenues, pay all bills of the operation of the WCID including payments to GBRA for debt service and operation and maintenance.

2. What are the propositions on the November 3, 2020 ballot?

The following propositions will be on the November 3, 2020 ballot to be selected FOR or AGAINST:

PROPOSITION A

THE CREATION OF LAKE PLACID WATER CONTROL AND IMPROVEMENT DISTRICT NO. 1

PROPOSITION B

THE PROVISIONS OF THE CONTRACT BETWEEN LAKE PLACID WATER CONTROL AND IMPROVEMENT DISTRICT NO. 1 AND THE GUADALUPE-BLANCO RIVER AUTHORITY, INCLUDING THE LEVY OF A TAX THEREUNDER FOR THE DEBT SERVICE REQUIREMENTS OF THE GUADALUPE-BLANCO RIVER AUTHORITY LAKE PLACID DAM AND HYDROELECTRIC FACILITIES BONDS AND FOR CHARGES ASSOCIATED WITH THE GUADALUPE-BLANCO RIVER AUTHORITY’S OPERATION AND MAINTENANCE OF THE LAKE PLACID DAM AND HYDROELECTRIC FACILITIES, ALL AS DEFINED AND PROVIDED IN SAID CONTRACT

PROPOSITION C

AN OPERATION AND MAINTENANCE TAX FOR FACILITIES AUTHORIZED BY ARTICLE XVI, SECTION 59, OF THE TEXAS CONSTITUTION, NOT TO EXCEED TWELVE CENTS ($0.12) PER ONE HUNDRED DOLLARS ($100) VALUATION OF TAXABLE PROPERTY

3. So, the tax rate will only be twelve cents ($0.12)?

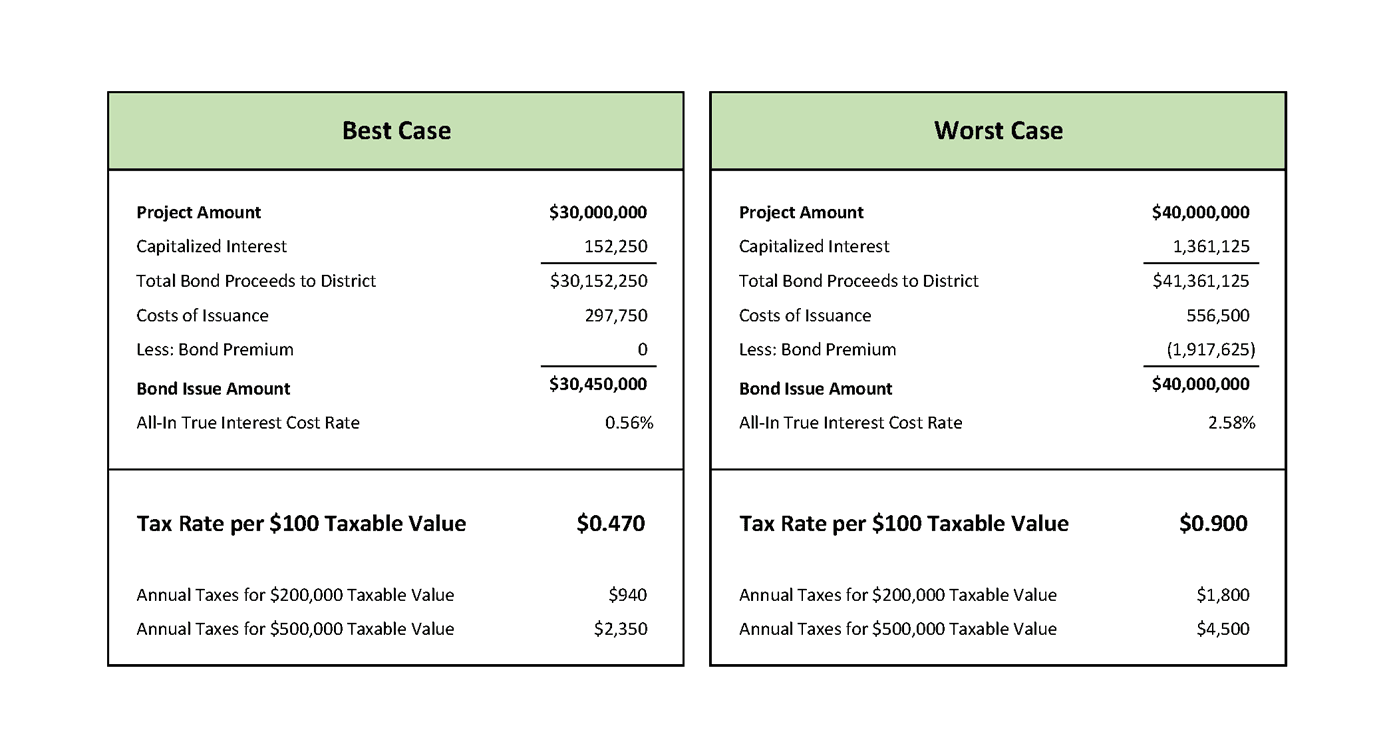

In accordance with Texas Election Code, Section 3.009, the District currently estimates that, if the propositions contained herein were approved and the bonds proposed herein were authorized and issued, with a maturity not to exceed 40 years, the District’s ad valorem debt service tax rate is projected to be a maximum of approximately $0.90 per $100 of assessed valuation. The estimated tax rate is based on current assumptions and projections of interest rates, property development, assessed valuations and tax collection rates. To the extent that such assumptions and projects are not realized, the actual tax rate assessed by the District may vary substantially from the estimated tax rate. The estimated tax rate provided in this Section shall not be considered part of the bond propositions to be submitted to the voters pursuant to this Order and shall not be considered as a limitation on the District’s authority to levy, assess and collect an unlimited tax as to rate or amount pursuant to Texas Constitution Article XVI, Section 59. This is assuming Lake Placid WCID No. 1 resorts to market rate bonds in the event they cannot secure contract rate bonds issued to the GBRA.

4. If $0.90 is the maximum, what is the minimum?

The scenario described above is a “worst case” solution. If Lake Placid WCID No. 1 is able to secure the contract rate bonds, then the tax rate would be closer to $0.47 per $100 of assessed valuation. This total ad valorem tax rate would combine the contract rate approved in Proposition B, estimated at $0.35 per $100 of assessed valuation, and the Operation and Maintenance tax rate of $0.12 per $100 of assessed valuation. This means on an average home value of $500,000, the annual tax implication would be roughly $2,350 if the “best case” scenario of $0.47 ad valorem tax rate were levied. At this time, the District does not expect to levy an ad valorem tax rate until tax year 2021, due in January 2022.

See below image of scenarios.

5. Who is eligible to vote in the November 3, 2020 ballot regarding the Lake Placid WCID No. 1 propositions?

In order to vote in the Lake Placid WCID No. 1 election on any or all propositions outlined above, an individual would need to be registered to vote at an address located within the boundaries of the District. Voter registration requirements are set by State law and are regulated by the Texas Secretary of State’s Office and the County Voter Registrar. For more information, please visit https://www.votetexas.gov/, or contact the Guadalupe County Voter Registrar, at 830-303-6363, or lisa.hayes@co.guadalupe.tx.us.

6. Why did the Lake Dunlap dam fail and how does that affect Lake Placid?

The Lake Dunlap and Lake Placid dams were built between 1927 and 1928 and are mostly comprised of their original components. The failure of the Dunlap dam was in the steel truss-like "gate" on top of the dam that is lowered during a rain event to provide flood management. Early engineering reports related to the Lake Dunlap dam failure indicate the lower hinges on the upriver gate failed at the Lake Dunlap dam. Due to the potential failure of the “bear trap” gates on the Lake Placid Dam, the renovation will include replacing these gates with modern “hydraulic crest” gates. The new gates will have the ability to be raised and lowered via a remotely-activated crane system.

7. Doesn't our dam provide flood control? Can't we get FEMA money?

Because Lake Placid does not have the capacity to store water like Canyon Lake, Lake Placid is considered a recreational lake only and not a flood control lake. Therefore, it does not qualify for FEMA grants or other federal assistance.

8. Who will own and maintain the renovated dam?

The GBRA will maintain ownership and be required to maintain the dam. The funding for the maintenance will come from the Operations and Maintenance tax rate levied by Lake Placid WCID No. 1.

Hydroelectric power will still be generated and sold as part of the operations of the dam, and Lake Placid WCID No. 1 will receive the revenues on behalf of the taxpayers. These revenues will be used to partially fund the debt service and a portion of the repair and replacement reserves. The hydroelectric generation revenues from Lake Placid have averaged approximately $520,000 annually during the last ten years.

9. Will Lake Placid be lowered?

The Lake Placid WCID No. 1 Board of Directors has outlined the lake will remain at “normal” level conditions for now. If the gates were to fail prior to the renovation project, then the lake would remain at the prevailing level until renovations could be completed.

10. What are the potential damage to fish habitats, trees, docks, and bulkheads? How will the vegetation of the lake be managed?

Efforts will be made to minimize detrimental impacts to the items mentioned. Partial dewatering is necessary to perform the dam improvements and gates installation. A dam gate failure would impact the fish habitats, trees, docks, and bulkheads similarly.

The Citizens United for Lake Placid (“CULP”) group will be included in discussions to address vegetation growth during dam construction. Homeowners can further aid in maintaining vegetation growth directly in front of their property.

11. How do I find more information regarding the election process, the GBRA draft contract, and more?

Lake Placid WCID No. 1 will continue to update the District website with educational materials up to and including early voting for the November 3, 2020 election.

For any questions you have that are not addressed on the District Website Election page, or between Lake Placid WCID No. 1 meetings, please contact the District through the ‘Contact Us’ form on the District website.